sales tax on leased cars in ny

Upon initially leasing the vehicle in New York this individual paid sales tax for the entire lease term. NY sales tax is computed on the sum of the monthly base payments.

Product Ideas Themed Event Event Prop Hire Yellow Taxi Cab Taxi Cab Event Props

For vehicles that are being rented or leased see see taxation of leases and rentals.

. If you leased the vehicle see register a leased vehicle. BMW Financial fronts the NYS sales tax to. General use tax rules for such.

In some states however the sales tax is just added to the lease payment on a. The highest possible tax rate is in New York which has a tax rate of 888. New York collects a 4 state sales tax rate on the purchase of all vehicles.

For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure. Sometimes you can do better in NY the doc fee is only 75 for instance so you may get a better price of 500 less on the car but if the doc fee is 500 more thats a wash. There are also a county or local taxes of up to 45.

Instead of paying all of the sales tax up front Person A opts to roll the tax into the monthly payments increasing the per month price to cover the sales tax and any interest charges. The math would be the following. While New Yorks sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

The most common method is to tax monthly lease payments at the local sales tax rate. Not all states have an agreement with New York. The Tax Department is responsible for administering the collection of the fee.

After the lessee moved to Florida the following year the leasing bank began charging Florida sales tax. The lowest city tax rate in New York is in Pleasantville which has a rate of 4. How to apply sales tax to lease or rental transactions.

For more information call 1. Services are subject to tax. Check out our selection of new Toyota cars at Sansone Toyota.

Also there was a sales tax charged on the capitalized cost reduction two separate sales tax charges of 18224 and. Lease Payment Before Taxes x 1 State Sales Tax The 1 represents 100 percent of the payment 55167 x 108 59580 This would be the payment with sales taxes included meaning that 4413 per month was sales tax for this particular payment. For example even though Delaware has no state sales tax it currently charges a document fee of 425 of the purchase price of a vehicle or the NADA book value whichever is more.

See DFT-804 page 2. This page describes the taxability of leases and rentals in New York including motor vehicles and tangible media property. Like with any purchase the rules on when and how much sales tax youll pay.

This gives you a state sales tax of 1700. So in New York with its 4 sales tax you will pay 1200 in taxes Otherwise youre paying taxes only on 10000. Unlike most states for long-term motor vehicle leases New York requires that sales tax be paid upfront based on the total amount of lease payments for the entire lease term.

Sales tax is a part of buying and leasing cars in states that charge it. Your trade-in vehicle is worth 7500 and you get a 2500 rebate. Lease Sales Tax in New York.

If you made monthly sales tax payments in another state complete form Statement of Transaction Sales Tax Form PDF at NY State Department of Tax and Finance DTF-802 and pay the total amount of NY State sales tax in one payment for all the lease payments that remain. However in New York the taxable amount is 42500 rebate is taxed Now multiple 42500 by 4. The highest possible tax rate is found in New York City which has a tax rate of 888.

In New York State the full sales tax is collected on that 16000 at the beginning of the lease. My monthly payment includes sales tax of 2453 total of 14958 for July - Dec. The average total car sales tax paid in New York state is 7915.

Publication 838 1212. You pay the tax rate in effect where the car is registered. If you roll this into your monthly payments for a 24-month lease it comes to about 28month or 1850month for a 36-month lease.

Additionally sales tax applies to any down payment the lease acquisition fee documentation fees warranty fees maintenance fees if charged transportation and destinations fees dealer advertising fees dealer prep fees literally everything in the lease. You can also deduct. I leased a new vehicle in July 2017.

But using the above example say the sales tax was 8 percent. Person A leases a vehicle from BMW in NYS and NYS sales tax is calculated as the monthly payment NYS sales tax inspection 36 month lease term. A car is a depreciating asset and therefore an expense and not an investment.

However their methodolgy is a bit different than other states that compute tax on the sum of the monthly base payments. Sales tax is computed on the sum of all lease payments at the usual rate in the county. I itemize my deductions.

In addition to taxes car purchases in New York may be subject to other fees like registration title and plate fees. You have a right to a second inspection at your expense by a licensed appraiser agreed to by the lessor. See Tax Bulletin How to Register for New York State Sales Tax TB-ST-360.

That comes to 66250 total. The sales tax in New Jersey for example is 6625. Any state that calculates initial taxes based on rental value as ny yes.

Sales - NY Serving Fleet Sizes. If the vehicle was a gift or was purchased from a family member use the Statement of Transaction Sales Tax Form pdf at NY State Department of Tax and Finance DTF-802 to receive a sales tax exemption. That puts your out-of-pocket cost at 40000.

To learn more see a full list of taxable and tax-exempt items in New York. The more you roll into the lease the higher your unpaid lease balance. Is this all I can deduct or can I deduct the sales tax for the entire 36 month term of the lease.

New York State and local sales taxes do not apply to the long-term lease of a motor vehicle even if the lessee enters into the lease and takes physical possession of the vehicle in New York State if at the time of taking delivery all of the following conditions are met. The myriad legal issues concerning hydrofracking in New York has in the 2010s spawned a new body of legal authority with. Keep in mind sales tax is different from all the state fees you may have to pay to register title or inspect a vehicle you lease or buy.

The lessee is not engaged in carrying on in New York State any. This means you only pay tax on the part of the car you lease not the entire value of the car. If you disagree with the lessors charge for excess wear and damage you may submit the dispute to binding arbitration established by the Attorney General.

When a dealer sells a motor vehicle to a resident of New York State the dealer must collect sales tax from the. The DMV calculates and collects the sales tax and issues a sales tax receipt.

A Helpful Tax Write Offs List For 1099 Contract Dance Teachers Special Thanks To Financialgroove Com For Providing Dance Teachers Tax Write Offs Dance Studio

Repost Unicoautodetailingny Good Night Tomorrow We Open At 9am Just Walk In No Appt Bmw Blackice Unicoautodetaili Bmw For Sale Cars For Sale Bmw

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

You Can Sell Your Leased Car For A Profit Here S How Much Yaa

Check Out This Great Deal On The 2014 Chrysler Town Country From One Of The Best Dealerships I Chrysler Town And Country Used Cars And Trucks Town And Country

While You Need To Wait For Hour After An Hour For A Public Transport Or A Cab You Can Easily Get A Car Within The Mentioned Ti Rent A Car Sofia

What Is Residual Value When You Lease A Car Credit Karma

2014 Bmw 3 Series 320i Xdrive Aut0 Sport Package Leather Sunroof 91k Cars For Sale Bmw Cars For Sale Used

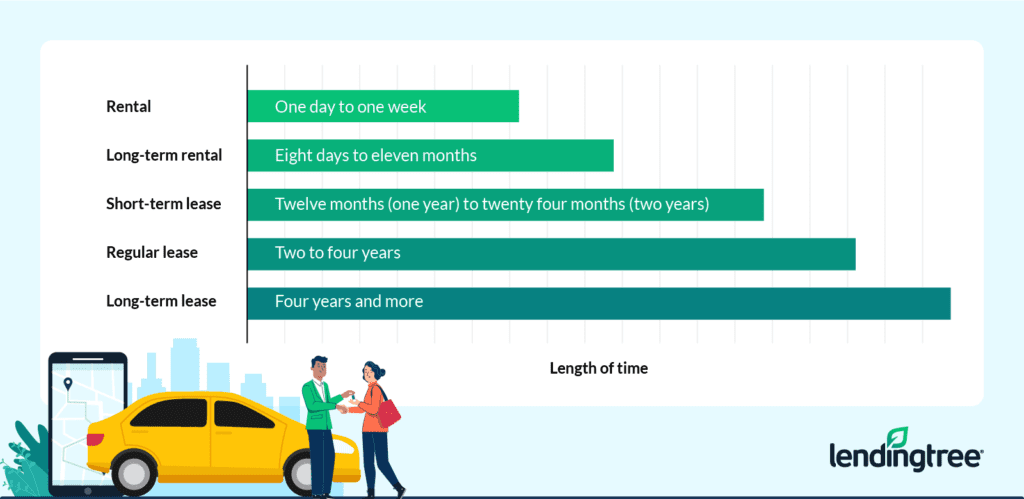

Short Term Car Leases Vs Long Term Car Rentals Lendingtree

Wheels To Lease Car Lease Blowout Deal Car Lease Used Cars And Trucks Mini Van

New Cars Trucks Suvs Toyota Dealership In Valley Stream Ny Toyota Hatchback Cars Yaris

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Pin On Future Goals To Achieve

New York Car Sales Tax Calculator Ny Car Sales Tax Facts